corporate tax increase uk

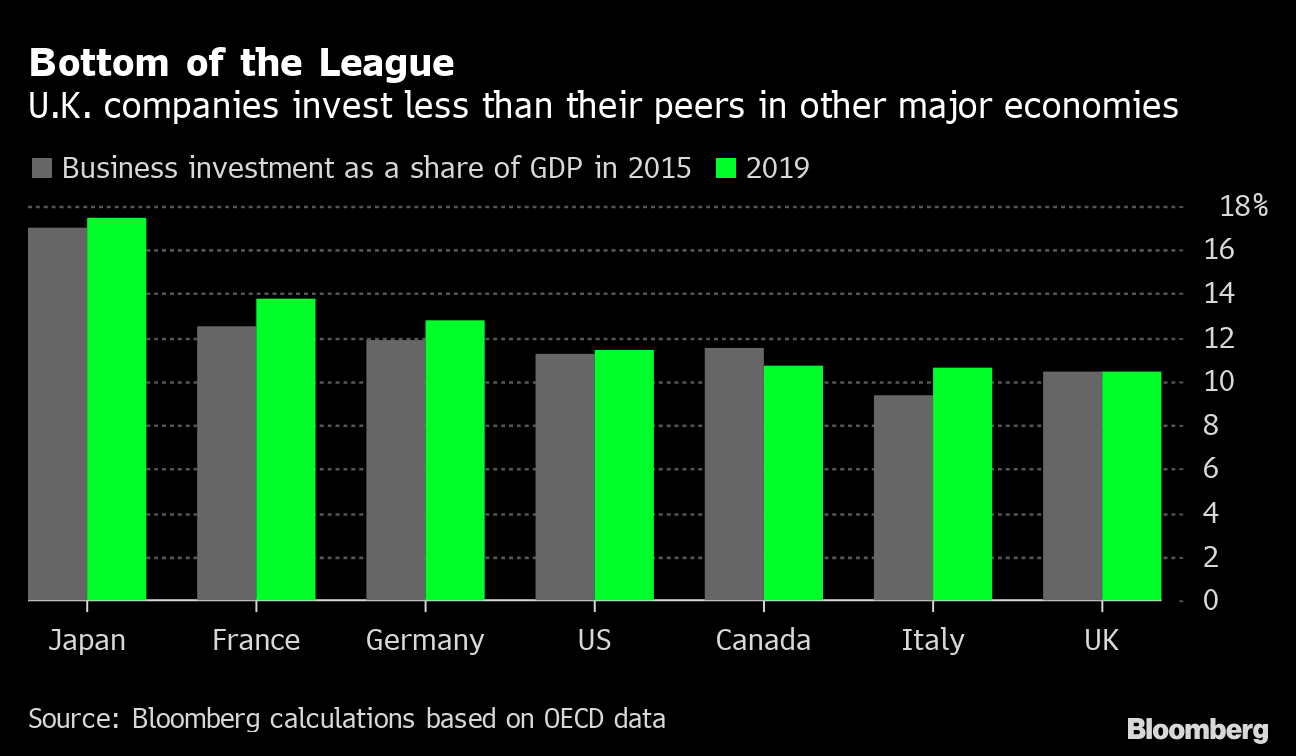

The rate of corporation tax paid on company profits is to rise to 25 from 19 starting in 2023. March 4 2021 0 12 Less than a minute LONDON.

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

The normal rate of corporation tax is 19 for the financial year beginning 1 April 2021 and will be maintained at this rate for the financial year beginning 1 April 2022.

. After this date a new higher rate comes into effect for companies with profits over 50000. Rishi Sunaks recent budget announcement means Britains businesses will face a corporation tax rise of 6 by 2023. From 1 April 2023 an increase from 19 to 25 in the main rate of corporation tax and the introduction of a 19 small profits rate of corporation tax for companies whose profits.

Rates The Corporation Tax rate for company profits is 19 You pay Corporation Tax at the rates that applied in your companys accounting period for Corporation Tax. If your companys profits exceed 50000 the 19. 19 for the financial year beginning 1 April 2022 25 for the financial year beginning 1 April 2023 Small Profits Rate at 19 for the.

LONDON British Finance Minister Rishi Sunak announced Wednesday that UK. Small firms with profits under 50000 will escape the rise. At Summer Budget 2015 the government announced legislation setting the Corporation Tax main rate for all profits except ring fence profits at 19 for the years starting 1 April 2017 2018 and.

Corporation Tax charge and main rate at. An increase in the rate of tax from 19 to 25 to apply to companies with profits over 250000 from April 2023. An increase in corporation tax from 19 to 25 from April 2023 is considered to be the most attractive option to begin the process of repaying the deficit.

It is an historically low rate and it will continue to be effective until 31 March 2023. There are different rates. Before this Budget over the past.

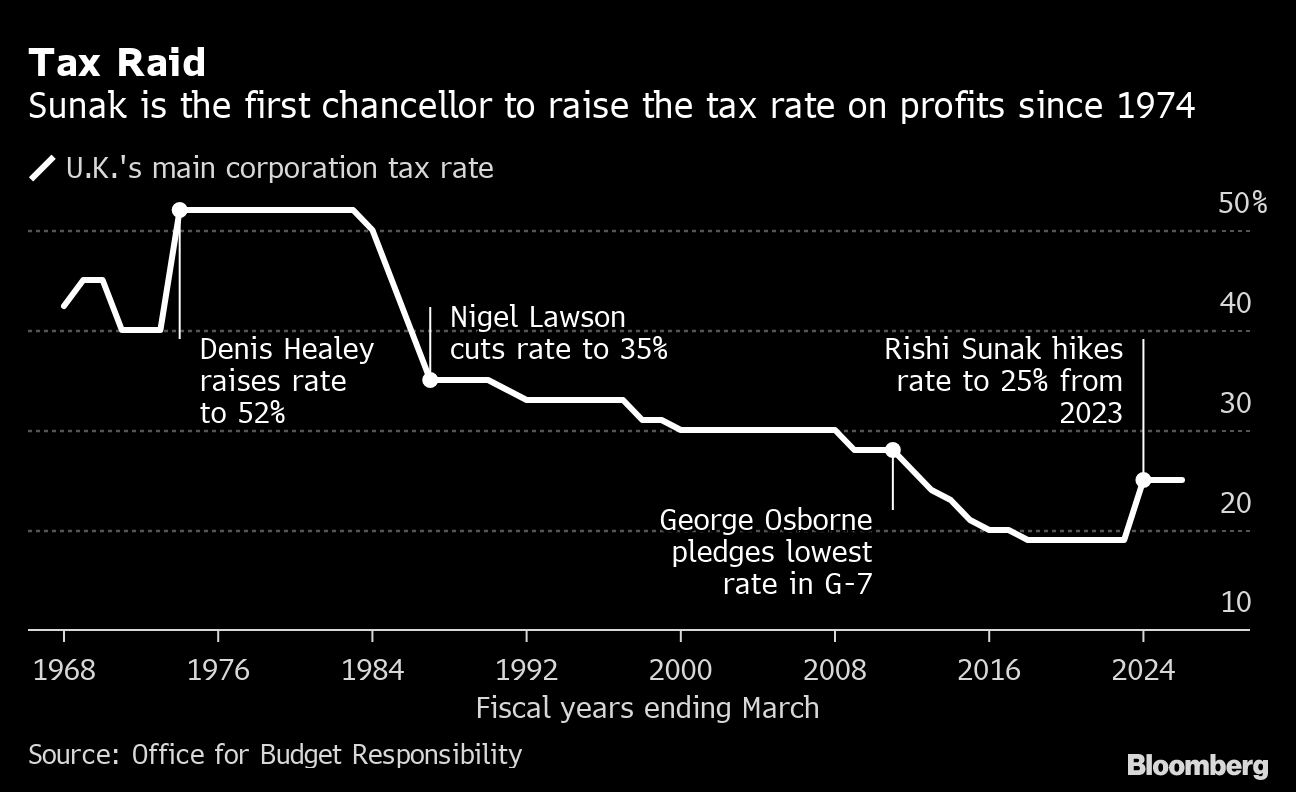

A tapered rate will also be introduced for profits. Businesses with profits of 50000 or less around 70 of actively trading companies will continue to be taxed at 19. The corporation tax surge is expected to raise 22bn in revenue a year with the tax take increasing from 488bn in 2022-23 to 713bn in 2023-24.

The introduction of a separate rate for companies with profits. The current rate of 19 the joint-fourth lowest of any OECD economy will. The Chancellor has confirmed that the Corporation Tax rate will rise to 25 from April 2023 with a system of tapered relief for companies with profits of between 50000 and.

The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to 25 percent. Corporation tax will increase to 25 in April 2023 as the government looks to restore public. From a corporation tax perspective the UK will no longer be subject to existing EU State aid rules and therefore the Government may have increased flexibility to introduce more.

However Finance Act 2021. According to the Chancellor an increase in the corporation tax rate from 19 to 25 percent will take effect on April 1 2023. UK will increase its corporate income tax on the largest and most profitable companies from 19 to 25 by 2023.

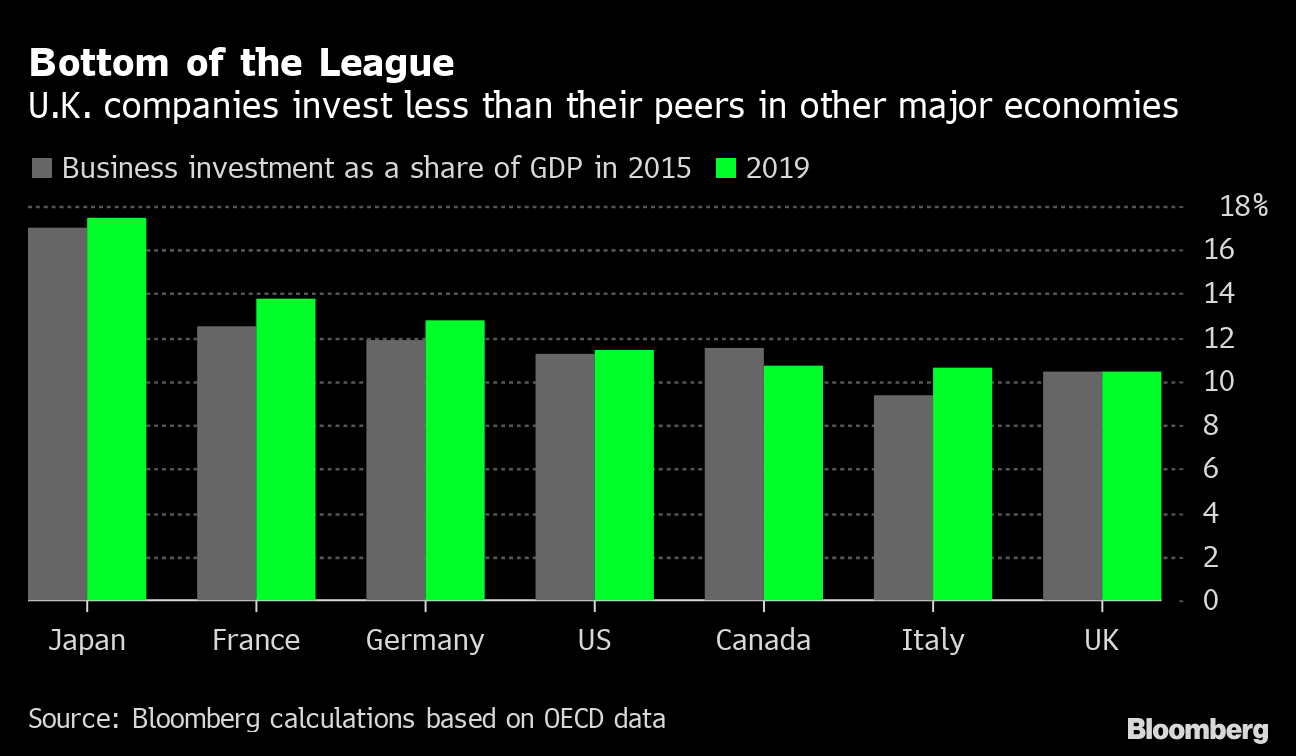

Corporation Tax Rate Increase in 2023 from 19 to 25 As a result of the corporation tax rate increase the full rate of 25 will be applicable to businesses making. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate. Until the beginning of the COVID-19 pandemic the UK Government was decreasing corporate tax with the aim of supporting investment in business.

5 Businesses Running Rings Round Hmrc Tax Research Uk Infographic Business Corporate

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

Dns Accounting Services In Portsmouth Uk Http Www Dnsassociates Co Uk Accountants In Portsmouth Accounting Services Tax Prep Payroll Accounting

Us Corporate Tax Rate Compared To Other Countries Business Infographic Small Business Infographic Infographic

Top Money Paid By Clickbank And Clicksure Go To This Website Http Im 6p3qdhcw Yourreputablereviews Com Charts And Graphs Tax Return Graphing

20 U S Companies That Paid 0 In Taxes Company Tax Us Companies

Tax Rates Charts And Graphs Chart Graphing

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Importance Of Cost Accounting In The Medical Practice Http Www Harleystreetaccountants Co Uk Importance O Cost Accounting Company Structure Medical Practice

How To Fund Basic Income In The Uk Part 3 Carbon Tax And Dividend Land Value Tax Dividend Income

Richard Burgon Mp On Twitter Richard Investing Twitter

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Corporate Tax By Country Around The World Infographic Infographic Around The Worlds Corporate

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

Windfall Tax Uk S Rishi Sunak Slaps 25 Levy On Profits Of Oil And Gas Firms Bloomberg

Budget 2012 George Osborne Raises Uk Growth Forecast Budget Forecasting Budgeting Smart Money

United Kingdom Corporation Tax Wikipedia In 2021 Financial Instrument Corporate United Kingdom

The Simple Reason Why Donald Trump Is Great For Corporate America Show Me The Money Stock Market How To Plan